Public Works

The Department of Public Works builds the foundation for a thriving city by providing essential services that enhance the community’s…

| Engineering |

| Solid Waste |

| Streets & Sewers |

| Utilities |

Administration & Finance

The Department of Administration & Finance supports the City's operations and mission by ensuring financial strength, managing the City's financial…

Community Investment

Spurring investment to create a stronger South Bend is the mission of our department. We do this by attracting and…

Fire

The South Bend Fire Department exists to provide our community with the highest quality emergency services protecting life and property…

| Emergency Medical Services |

| Recruitment |

Police

We strive to protect the life, property, and personal liberties of all individuals. It’s our belief the overall quality of…

| Chronic Problem Properties |

Legal

We provide quality legal representation to the City of South Bend's departments, commissions, and agencies, efficiently and cost effectively, with…

| Ordinance Violations Bureau |

| Americans With Disabilities Act (ADA) |

| Title VI |

| Public Records Request |

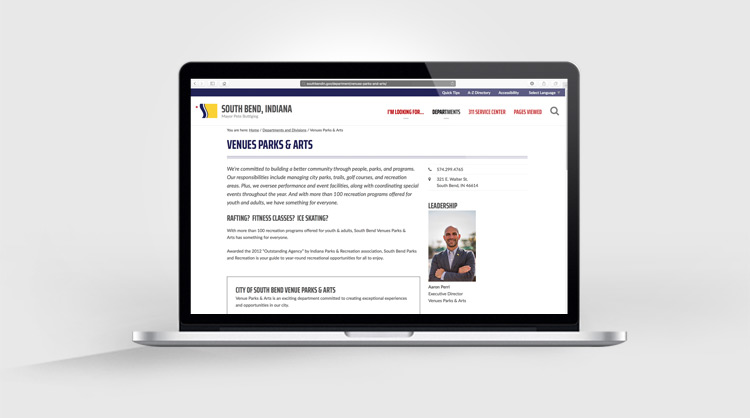

Venues Parks & Arts

Venues Parks & Arts inspires a more liveable South Bend for all, connecting us to emotionally engaging experiences and to…

| Office of Community Initiatives |

| Beck’s Lake, EPA Superfund Information |

Innovation & Technology

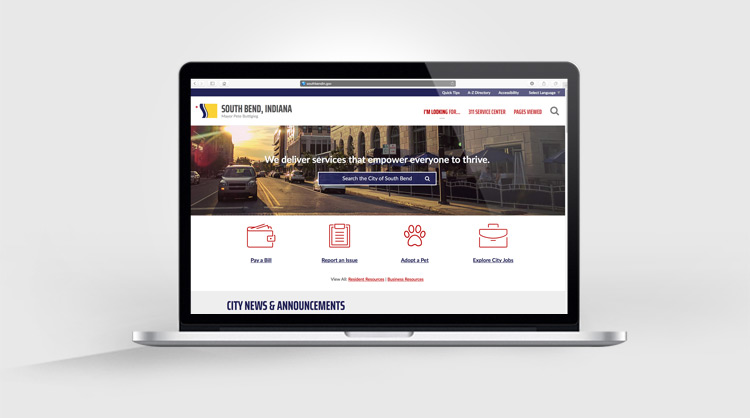

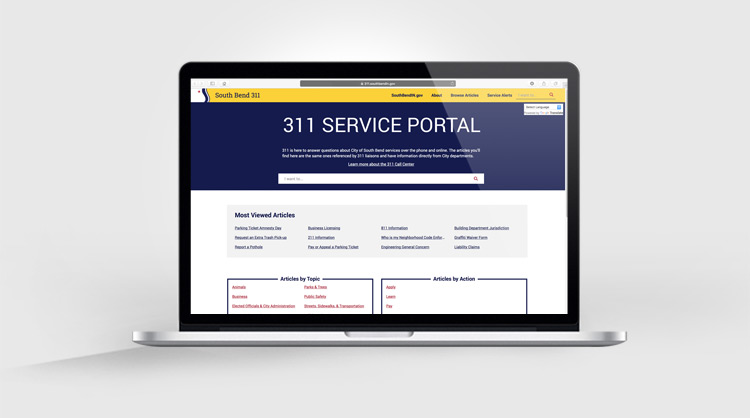

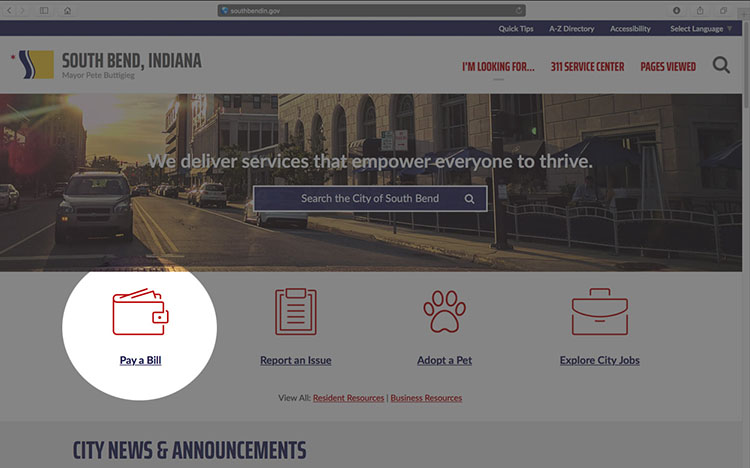

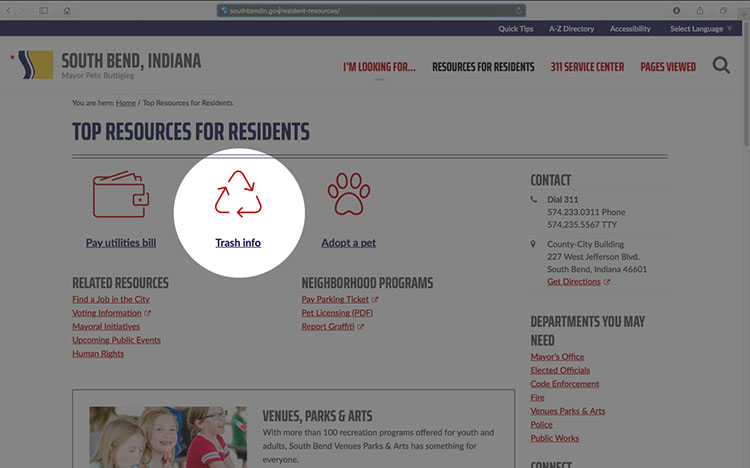

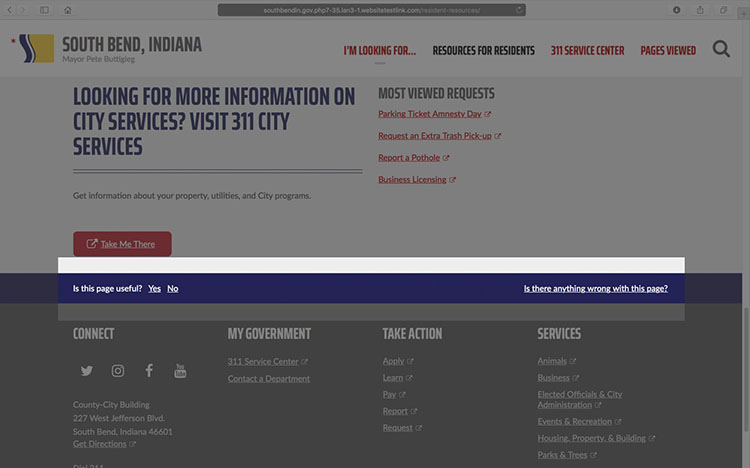

Our department improves resident life through innovation and technology. We ensure city technology is effective and functional. We empower city…

| South Bend User Experience (SB UX) |

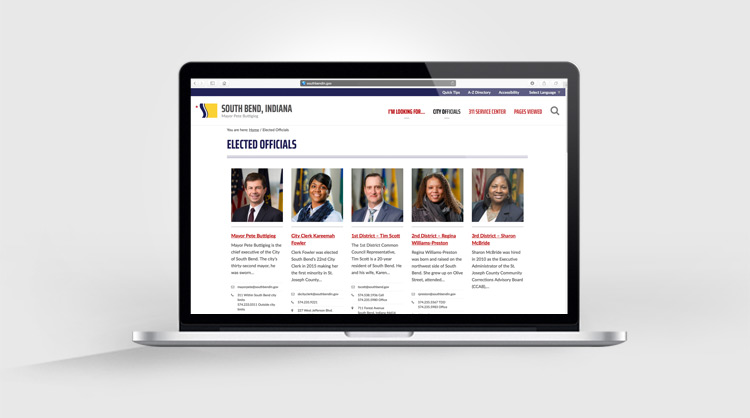

City Clerk’s Office

The City Clerk is the Clerk of the South Bend Common Council. The Clerk is elected by the voters of the…

Common Council

Council Mission Statement: To make certain that our City Government is always responsive to the needs of our residents &…

| Youth Advisory Council |

| Join a Committee, Board, or Commission |

| Rules and Procedures |

| Council Initiatives |

Mayor’s Office

Mayor Mueller is the chief executive of the City of South Bend. The city’s thirty-third mayor, he was sworn into…

| Diversity, Compliance, & Inclusion |

| Meet the Staff |

South Bend Animal Resource Center

We're responsible for animal welfare services in the City. Our Resource Center services include animal adoption, lost and found support,…

| Ordinances and Reporting |

| Pet Adoption |

| Animal Care & Control |